Introduction

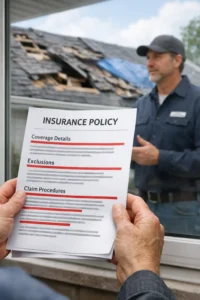

The St. Louis region has been hit hard in recent years with hailstorms, tornadoes, high winds, and heavy rain. Alongside the physical damage these storms bring, many homeowners are facing another challenge: changing insurance policies. These changes directly affect how claims are processed and what coverage homeowners actually receive when damage occurs.

At Exterior Building Solutions (EBS), we’ve seen firsthand how these policy shifts impact homeowners. In this article, Josh Knese, a licensed insurance adjuster and roofing expert with EBS, explains the latest changes and what you can do to protect yourself.

The Shift Toward Actual Cash Value (ACV) Policies

Traditionally, many homeowners carried replacement cost coverage, which pays the full cost of replacing damaged items at today’s market value. But more insurance carriers are moving toward actual cash value (ACV)policies.

Josh explains it this way:

“Replacement cost is the insurance company will pay you for what it costs to replace those damaged items in the current market. Whereas actual cash value, they pay you for the depreciated value of those items.”

That means once your roofing or siding materials are installed, they begin to lose value, just like a car does when driven off the lot. With ACV coverage, the lost value (depreciation) is not covered, and you may be left paying the difference out of pocket.

Cosmetic Damage Exclusions

Another major trend is cosmetic damage exclusions. This applies to soft metals on your home, like fascia, gutters, roof vents, and aluminum wraps.

If a hailstorm dents your gutters but they’re still functioning, your insurance company may deny coverage. Unfortunately, while these materials may technically still “work,” cosmetic damage lowers curb appeal and can reduce your home’s resale value.

Percentage Based Deductibles

In the past, deductibles were usually fixed amounts such as $1,000 or $2,000. Increasingly, insurers are switching to percentage based deductiblestied to your home’s value.

For example, with a $500,000 home and a 2% wind and hail deductible, you’d be responsible for $10,000out of pocket before insurance coverage begins. Many homeowners don’t realize this change until they file a claim and face the unpleasant surprise.

How Homeowners Can Protect Themselves

While these changes can feel overwhelming, there are proactive steps you can take:

1. Review Your Insurance Policy

Most people receive renewal paperwork, sign it, and file it away without reading. Take time to go through it. Look for terms like ACV coverage, cosmetic exclusions, and percentage based deductibles.

2. Work with a Trusted Insurance Agent

Don’t just shop for the cheapest policy. A good agent will explain coverage options and help you choose protection that truly fits your home’s needs.

3. Upgrade to Impact Resistant Roofing Materials

Consider investing in Class 4 impact rated shingles. Not only do these reduce the risk of damage, but many carriers also offer premium discounts for using them. Over time, this upgrade pays for itself.

4. Get a Professional Inspection After Storms

Even if you don’t see leaks or obvious damage, hidden storm damage can worsen over time. Most insurers only give you 1 to 2 years from the date of lossto file a claim. At EBS, we offer free storm damage inspections in St. Louis, helping homeowners catch issues early and avoid missing that window.

Why Work with Exterior Building Solutions?

The insurance process can be confusing, especially for homeowners filing a claim for the first time. That’s where we step in.

Josh shares:

“Our goal in every insurance claim is for us to take on the workload and the homeowner to go on about their daily life knowing that they are in good hands and they’re gonna be taken care of.”

At EBS, we don’t just repair roofs, siding, and gutters, we guide you through the entire claims process. With Josh’s experience as a licensed insurance adjuster, our team ensures you get the coverage you’re entitled to and that your home is restored the right way.

Key Takeaways

- Insurance policies are shifting toward ACV coverage, cosmetic exclusions, and percentage based deductibles, which can increase homeowner costs.

- Reviewing your policy and asking your agent questions can help prevent surprises.

- Upgrading to impact resistant shinglescan save money on premiums and reduce storm damage risk.

- A professional storm inspectionensures damage is documented and claims are filed on time.

- EBS advocates for homeownersthrough the claims process, ensuring fair coverage and quality repairs.

Conclusion

Storms in St. Louis aren’t going away, but that doesn’t mean you need to be caught off guard by insurance surprises. Being proactive with your policy, making smart upgrades, and partnering with a trusted contractor like Exterior Building Solutionscan save you thousands of dollars and protect your home’s value.

Don’t wait until the next storm hits. Call EBS at (314) 729-7663today for a free inspection and peace of mind.

FAQs

- What’s the difference between ACV and replacement cost?

ACV pays the depreciated value of damaged items, while replacement cost covers the full cost to replace them at today’s prices. - What is the cosmetic damage exclusion?

It excludes coverage for visible but non-functional, damage, like hail dents in gutters or fascia. - How do percentage based deductibles work?

Instead of a flat fee, your deductible is a percentage of your home’s value often much higher than traditional deductibles. - Can upgrading my roof lower insurance costs?

Yes. Class 4 impact rated shingles often qualify for premium discounts and reduce the risk of storm damage. - How soon should I get a storm inspection?

As soon as possible, most insurers require claims within 1 to 2 years of the storm date.

0 Comments